| Appraised Value | Assessed Value | |

| Building Value | $ 266,300 | $ 266,300 |

| Extra Features | $ 27,700 | $ 27,700 |

| Outbuildings | $ 4,000 | $ 4,000 |

| Land Value | $ 149,600 | $ 149,600 |

| Totals | $ 447,600 | $ 447,600 |

| 2024

Community Preservation Act Tax $ 46.54 Hyannis FD Tax (Commercial) $ 0 Hyannis FD Tax (Residential) $ 1,074.24 Town Tax (Commercial) $ 0 Town Tax (Residential) $ 1,551.36 Total: $ 2,672.14 |

2023

Community Preservation Act Tax $ 50.90 Hyannis FD Tax (Commercial) $ 0 Hyannis FD Tax (Residential) $ 979 Town Tax (Commercial) $ 0 Town Tax (Residential) $ 1,696.69 Total: $ 2,726.59 |

| Residential Exemption Received= $214,313 |

Residential Exemption Received= $151,616 |

| Owner: | Sale Date | Book/Page: | Sale Price: |

| MCWADE, MATTHEW JOSEPH | 2013-09-06 | 27673/0300 | $231000 |

| CASEY, PATRICK & KERRY D | 2009-01-29 | 23404/0259 | $219500 |

| STANLEY, DEAN F | 2008-10-17 | 23217/0314 | $151000 |

| LASALLE BANK NATIONAL ASSOC TR | 2008-01-08 | 22590/0230 | $232709 |

| MASON, CATHERINE | 2000-02-01 | 12810/0343 | $1 |

| MASON, THERESA M & CATHY | 1998-12-31 | 11958/0268 | $116000 |

| FASANO, DAVID | 1997-10-31 | 11035/0293 | $107000 |

| RODRIQUES, PHYLLIS | 1996-10-30 | 10461/0133 | $68000 |

| ADVANTA MORTG CORP USA | 1996-08-15 | 10361/0180 | $40000 |

| LAI, VINCENT K & MARY JEAN | 1977-11-16 | 2616/0302 | $32000 |

| As Built Cards:Click card # to view: | Card #1 | | Card #2 | |

| B2N | Barn-any 2nd story area | FPC | Open Porch Concrete Floor | REF | Reference Only |

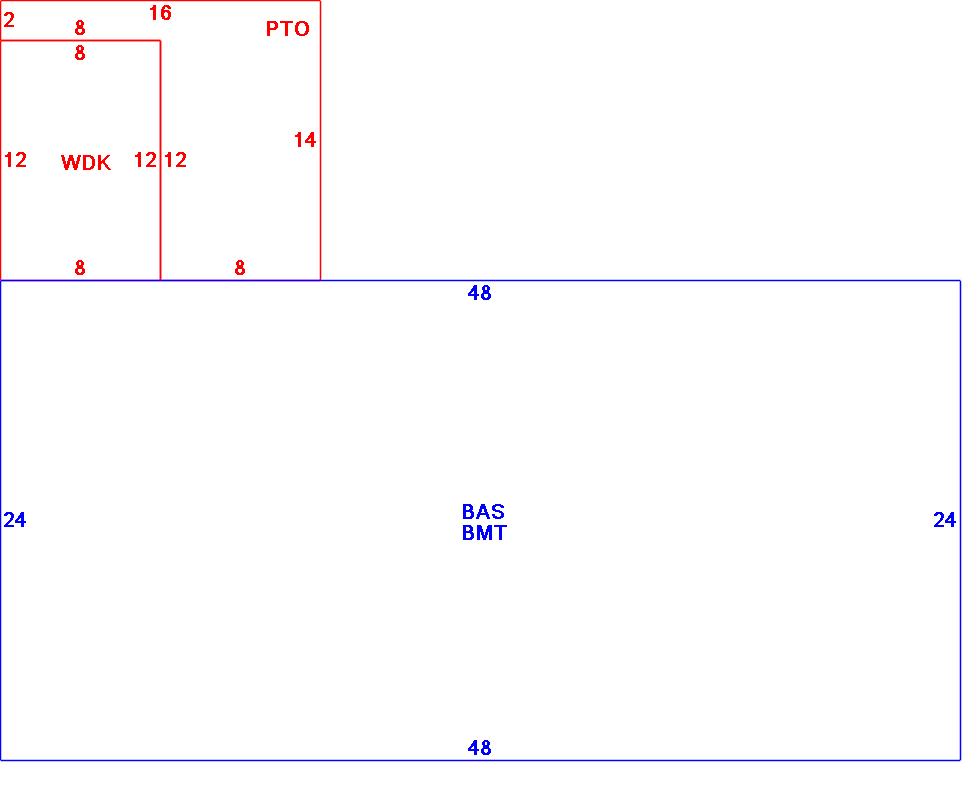

| BAS | First Floor, Living Area | FTS | Third Story Living Area (Finished) | SOL | Solarium |

| BMT | Basement Area (Unfinished) | FUS | Second Story Living Area (Finished) | SPE | Pool Enclosure |

| BRN | Barn | GAR | Garage | TQS | Three Quarters Story (Finished) |

| CAN | Canopy | GAZ | Gazebo | UAT | Attic Area (Unfinished) |

| CLP | Loading Platform | GRN | Greenhouse | UHS | Half Story (Unfinished) |

| FAT | Attic Area (Finished) | GXT | Garage Extension Front | UST | Utility Area (Unfinished) |

| FCP | Carport | KEN | Kennel | UTQ | Three Quarters Story (Unfinished) |

| FEP | Enclosed Porch | MZ1 | Mezzanine, Unfinished | UUA | Unfinished Utility Attic |

| FHS | Half Story (Finished) | PRG | Pergola | UUS | Full Upper 2nd Story (Unfinished) |

| FOP | Open or Screened in Porch | PRT | Portico | WDK | Wood Deck |

| PTO | Patio | ||||

Building |

Details |

Land |

|||

| Building value | $ 266,300 | Bedrooms | 3 Bedrooms | USE CODE | 1010 |

| Replacement Cost | $328,758 | Bathrooms | 1 Full-1 Half | Lot Size (Acres) | 0.27 |

| Model | Residential | Total Rooms | 5 Rooms | Appraised Value | $ 149,600 |

| Style | Ranch | Heat Fuel | Gas | Assessed Value | $ 149,600 |

| Grade | Average | Heat Type | Hot Water | ||

| Year Built | 1976 | AC Type | None | ||

| Effective depreciation | 19 | Interior Floors | CarpetVinyl/Asphalt | ||

| Stories | 1 Story | Interior Walls | Drywall | ||

| Living Area sq/ft | 1,152 | Exterior Walls | Wood Shingle | ||

| Gross Area sq/ft | 2,528 | Roof Structure | Gable/Hip | ||

| Roof Cover | Asph/F Gls/Cmp | ||||

| Code | Description | Units/SQ ft | Appraised Value | Assessed Value |

| FPL1 | Fireplace 1 story | 1 | $ 4,100 | $ 4,100 |

| PAT1 | Patio- Average | 128 | $ 700 | $ 700 |

| BMT | Basement-Unfinished | 1152 | $ 23,600 | $ 23,600 |

| WDCK | Wood Decking w/railings | 96 | $ 3,300 | $ 3,300 |