| Appraised Value | Assessed Value | |

| Building Value | $ 427,000 | $ 427,000 |

| Extra Features | $ 50,500 | $ 50,500 |

| Outbuildings | $ 10,900 | $ 10,900 |

| Land Value | $ 144,300 | $ 144,300 |

| Totals | $ 632,700 | $ 632,700 |

| 2024

Community Preservation Act Tax $ 83.47 Hyannis FD Tax (Commercial) $ 0 Hyannis FD Tax (Residential) $ 1,518.48 Town Tax (Commercial) $ 0 Town Tax (Residential) $ 2,782.27 Total: $ 4,384.22 |

2023

Community Preservation Act Tax $ 84.86 Hyannis FD Tax (Commercial) $ 0 Hyannis FD Tax (Residential) $ 1,379.25 Town Tax (Commercial) $ 0 Town Tax (Residential) $ 2,828.59 Total: $ 4,292.70 |

| Residential Exemption Received= $214,313 |

Residential Exemption Received= $151,616 |

| Owner: | Sale Date | Book/Page: | Sale Price: |

| BROWN, SUSAN E | 2017-09-24 | 30882/0215 | $0 |

| BROWN, BARBARA J & SUSAN E | 2000-11-09 | 13356/0216 | $251000 |

| DACEY, BRIAN T TR | 1997-12-03 | 11096/0080 | $1969000 |

| COBBLESTONE LANDING INC | 1994-04-01 | 9128/0054 | $100 |

| FRANCO R E DEV CO, INC | 1992-01-28 | 7851/0158 | $1 |

AsBuilt Card N/A

| B2N | Barn-any 2nd story area | FPC | Open Porch Concrete Floor | REF | Reference Only |

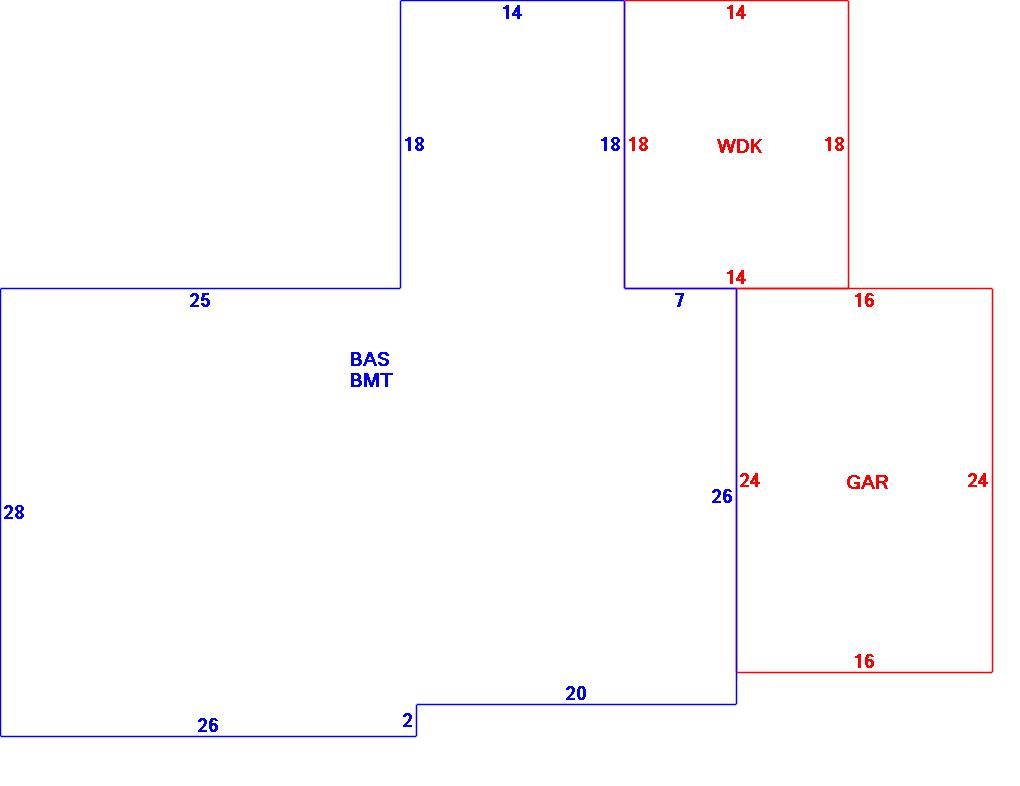

| BAS | First Floor, Living Area | FTS | Third Story Living Area (Finished) | SOL | Solarium |

| BMT | Basement Area (Unfinished) | FUS | Second Story Living Area (Finished) | SPE | Pool Enclosure |

| BRN | Barn | GAR | Garage | TQS | Three Quarters Story (Finished) |

| CAN | Canopy | GAZ | Gazebo | UAT | Attic Area (Unfinished) |

| CLP | Loading Platform | GRN | Greenhouse | UHS | Half Story (Unfinished) |

| FAT | Attic Area (Finished) | GXT | Garage Extension Front | UST | Utility Area (Unfinished) |

| FCP | Carport | KEN | Kennel | UTQ | Three Quarters Story (Unfinished) |

| FEP | Enclosed Porch | MZ1 | Mezzanine, Unfinished | UUA | Unfinished Utility Attic |

| FHS | Half Story (Finished) | PRG | Pergola | UUS | Full Upper 2nd Story (Unfinished) |

| FOP | Open or Screened in Porch | PRT | Portico | WDK | Wood Deck |

| PTO | Patio | ||||

Building |

Details |

Land |

|||

| Building value | $ 427,000 | Bedrooms | 3 Bedrooms | USE CODE | 1010 |

| Replacement Cost | $474,474 | Bathrooms | 2 Full-0 Half | Lot Size (Acres) | 0.21 |

| Model | Residential | Total Rooms | 7 Rooms | Appraised Value | $ 144,300 |

| Style | Ranch | Heat Fuel | Gas | Assessed Value | $ 144,300 |

| Grade | Average Plus | Heat Type | Hot Air | ||

| Year Built | 2000 | AC Type | Central | ||

| Effective depreciation | 10 | Interior Floors | Hardwood | ||

| Stories | 1 Story | Interior Walls | Drywall | ||

| Living Area sq/ft | 1,500 | Exterior Walls | Wood Shingle | ||

| Gross Area sq/ft | 3,636 | Roof Structure | Gable/Hip | ||

| Roof Cover | Asph/F Gls/Cmp | ||||

| Code | Description | Units/SQ ft | Appraised Value | Assessed Value |

| FPL1 | Fireplace 1 story | 1 | $ 4,500 | $ 4,500 |

| WDCK | Wood Decking w/railings | 252 | $ 3,900 | $ 3,900 |

| GAR | Attached Garage | 384 | $ 14,100 | $ 14,100 |

| BMT | Basement-Unfinished | 1500 | $ 31,900 | $ 31,900 |

| GEN | Emergency Generator | 1 | $ 5,300 | $ 5,300 |

| SHED | Shed | 96 | $ 1,700 | $ 1,700 |