| Appraised Value | Assessed Value | |

| Building Value | $ 1,091,300 | $ 1,091,300 |

| Extra Features | $ 44,000 | $ 44,000 |

| Outbuildings | $ 149,700 | $ 149,700 |

| Land Value | $ 974,600 | $ 974,600 |

| Totals | $ 2,259,600 | $ 2,259,600 |

| 2024

Community Preservation Act Tax $ 408.03 Cotuit FD Tax (Commercial) $ 0 Cotuit FD Tax (Residential) $ 2,779.31 Town Tax (Commercial) $ 0 Town Tax (Residential) $ 13,601.16 Total: $ 16,788.50 |

2023

Community Preservation Act Tax $ 378.32 Cotuit FD Tax (Commercial) $ 0 Cotuit FD Tax (Residential) $ 2,515.89 Town Tax (Commercial) $ 0 Town Tax (Residential) $ 12,610.65 Total: $ 15,504.86 |

| Residential Exemption Received= $214,313 |

Residential Exemption Received= $151,616 |

| Owner: | Sale Date | Book/Page: | Sale Price: |

| BLIZARD, SCOTT A & LAURIE S | 2013-12-11 | C202239/0 | $1040000 |

| VIRGINIA V BUSH TRUST | 2004-05-28 | C173186/0 | $1 |

| DEE, VIRGINIA V | 1982-03-29 | C88271/0 | $200000 |

| As Built Cards:Click card # to view: | Card #1 | | Card #2 | | Card #3 | | Card #4 | | Card #5 | | Card #7 | | Card #64 | |

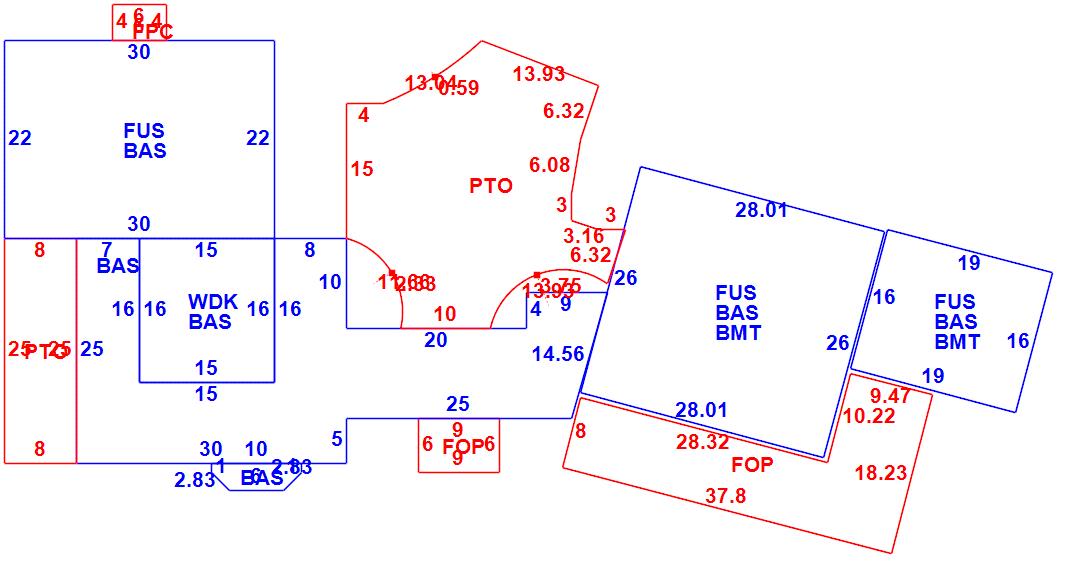

| B2N | Barn-any 2nd story area | FPC | Open Porch Concrete Floor | REF | Reference Only |

| BAS | First Floor, Living Area | FTS | Third Story Living Area (Finished) | SOL | Solarium |

| BMT | Basement Area (Unfinished) | FUS | Second Story Living Area (Finished) | SPE | Pool Enclosure |

| BRN | Barn | GAR | Garage | TQS | Three Quarters Story (Finished) |

| CAN | Canopy | GAZ | Gazebo | UAT | Attic Area (Unfinished) |

| CLP | Loading Platform | GRN | Greenhouse | UHS | Half Story (Unfinished) |

| FAT | Attic Area (Finished) | GXT | Garage Extension Front | UST | Utility Area (Unfinished) |

| FCP | Carport | KEN | Kennel | UTQ | Three Quarters Story (Unfinished) |

| FEP | Enclosed Porch | MZ1 | Mezzanine, Unfinished | UUA | Unfinished Utility Attic |

| FHS | Half Story (Finished) | PRG | Pergola | UUS | Full Upper 2nd Story (Unfinished) |

| FOP | Open or Screened in Porch | PRT | Portico | WDK | Wood Deck |

| PTO | Patio | ||||

Building |

Details |

Land |

|||

| Building value | $ 1,091,300 | Bedrooms | 5 Bedrooms | USE CODE | 1010 |

| Replacement Cost | $1,494,944 | Bathrooms | 4 Full-2 Half | Lot Size (Acres) | 1.06 |

| Model | Residential | Total Rooms | 10 Rooms | Appraised Value | $ 974,600 |

| Style | Conventional | Heat Fuel | Gas | Assessed Value | $ 974,600 |

| Grade | Custom Plus | Heat Type | Hot Air | ||

| Year Built | 1850 | AC Type | Central | ||

| Effective depreciation | 27 | Interior Floors | CarpetHardwood | ||

| Stories | 2 Stories | Interior Walls | Plastered | ||

| Living Area sq/ft | 4,458 | Exterior Walls | Wood Shingle | ||

| Gross Area sq/ft | 7,066 | Roof Structure | Gable/Hip | ||

| Roof Cover | Wood Shingle | ||||

| Code | Description | Units/SQ ft | Appraised Value | Assessed Value |

| FPL3 | Fireplace 2 story | 2 | $ 10,200 | $ 10,200 |

| WDCK | Wood Decking w/railings | 240 | $ 4,700 | $ 4,700 |

| PATC | Conc Pavers W/Conc | 859 | $ 8,200 | $ 8,200 |

| FOPC | Open Prch-roof, ceiling | 24 | $ 1,200 | $ 1,200 |

| BMT | Basement-Unfinished | 1032 | $ 19,800 | $ 19,800 |

| FOP | Open Porch-roof-ceiling | 453 | $ 12,800 | $ 12,800 |

| GEN | Emergency Generator | 1 | $ 5,600 | $ 5,600 |

| GAR4 | Det Gar-w/FUS | 800 | $ 127,700 | $ 127,700 |

| WDCK | Wood Decking w/railings | 126 | $ 3,500 | $ 3,500 |