| Appraised Value | Assessed Value | |

| Building Value | $ 320,900 | $ 320,900 |

| Extra Features | $ 57,500 | $ 57,500 |

| Outbuildings | $ 140,400 | $ 140,400 |

| Land Value | $ 864,400 | $ 864,400 |

| Totals | $ 1,383,200 | $ 1,383,200 |

| 2024

C.O.M.M. FD Tax (Commercial) $ 0 C.O.M.M. FD Tax (Residential) $ 1,604.51 Community Preservation Act Tax $ 275.95 Town Tax (Commercial) $ 0 Town Tax (Residential) $ 9,198.28 Total: $ 11,078.74 |

2023

C.O.M.M. FD Tax (Commercial) $ 0 C.O.M.M. FD Tax (Residential) $ 1,486.15 Community Preservation Act Tax $ 248.20 Town Tax (Commercial) $ 0 Town Tax (Residential) $ 8,273.31 Total: $ 10,007.66 |

| Owner: | Sale Date | Book/Page: | Sale Price: |

| HOLMGREN, BRETT J & KATHERINE | 2021-04-02 | 33970/284 | $1170000 |

| VEITAS, VIDA R | 2020-07-29 | 33116/0019 | $825000 |

| HOLLANDER, RONALD S & TOBY S | 2002-06-14 | 15265/0152 | $432500 |

| ROWE, MICHAEL A & MARJORIE | 1991-05-01 | 7516/0015 | $145000 |

| OSTERVILLE BAPTIST CHURCH | 1968-07-05 | 1406/0640 | $0 |

| As Built Cards:Click card # to view: | Card #1 | |

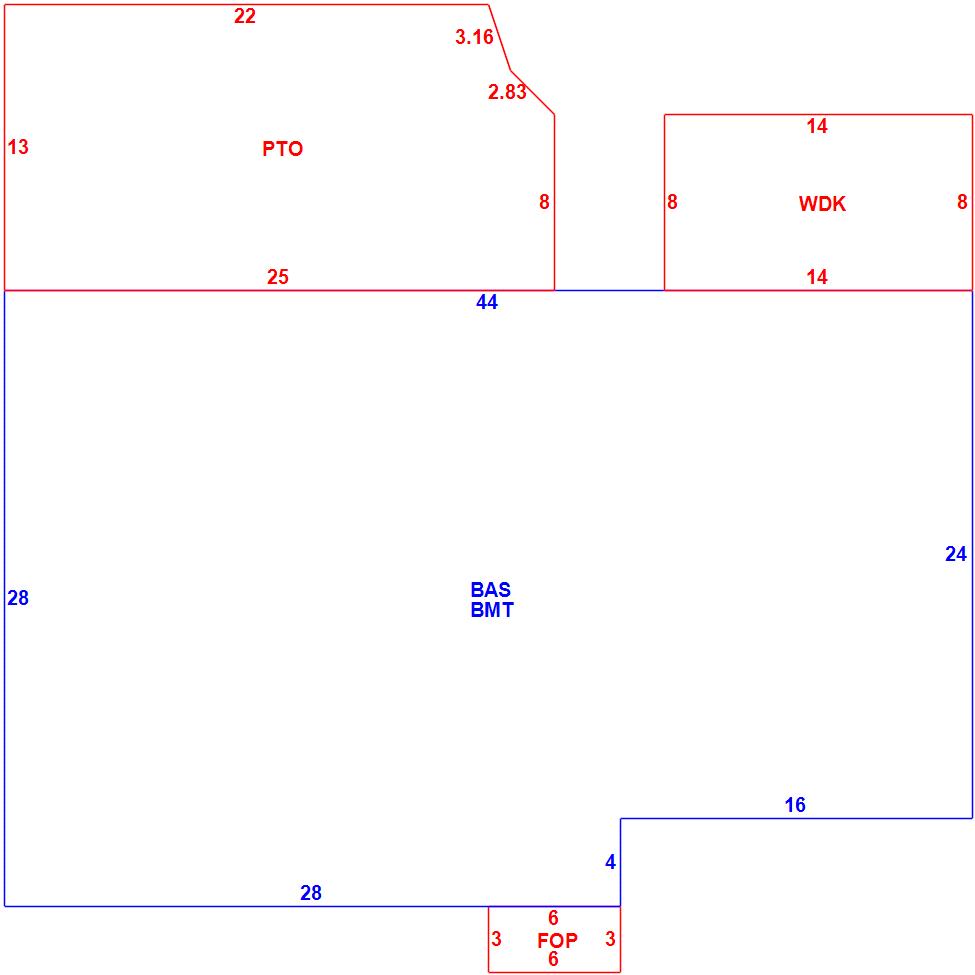

| B2N | Barn-any 2nd story area | FPC | Open Porch Concrete Floor | REF | Reference Only |

| BAS | First Floor, Living Area | FTS | Third Story Living Area (Finished) | SOL | Solarium |

| BMT | Basement Area (Unfinished) | FUS | Second Story Living Area (Finished) | SPE | Pool Enclosure |

| BRN | Barn | GAR | Garage | TQS | Three Quarters Story (Finished) |

| CAN | Canopy | GAZ | Gazebo | UAT | Attic Area (Unfinished) |

| CLP | Loading Platform | GRN | Greenhouse | UHS | Half Story (Unfinished) |

| FAT | Attic Area (Finished) | GXT | Garage Extension Front | UST | Utility Area (Unfinished) |

| FCP | Carport | KEN | Kennel | UTQ | Three Quarters Story (Unfinished) |

| FEP | Enclosed Porch | MZ1 | Mezzanine, Unfinished | UUA | Unfinished Utility Attic |

| FHS | Half Story (Finished) | PRG | Pergola | UUS | Full Upper 2nd Story (Unfinished) |

| FOP | Open or Screened in Porch | PRT | Portico | WDK | Wood Deck |

| PTO | Patio | ||||

Building |

Details |

Land |

|||

| Building value | $ 320,900 | Bedrooms | 3 Bedrooms | USE CODE | 1010 |

| Replacement Cost | $396,142 | Bathrooms | 2 Full-0 Half | Lot Size (Acres) | 0.5 |

| Model | Residential | Total Rooms | 6 Rooms | Appraised Value | $ 864,400 |

| Style | Split-Level | Heat Fuel | Gas | Assessed Value | $ 864,400 |

| Grade | Average Plus | Heat Type | Hot Water | ||

| Year Built | 1957 | AC Type | Central | ||

| Effective depreciation | 19 | Interior Floors | Ceram Clay TilHardwood | ||

| Stories | 1 Story | Interior Walls | Drywall | ||

| Living Area sq/ft | 1,168 | Exterior Walls | Wood Shingle | ||

| Gross Area sq/ft | 2,782 | Roof Structure | Gable/Hip | ||

| Roof Cover | Asph/F Gls/Cmp | ||||

| Code | Description | Units/SQ ft | Appraised Value | Assessed Value |

| BFA1 | Bsmt Fin-Good-Partitioned | 1068 | $ 28,200 | $ 28,200 |

| FPL1 | Fireplace 1 story | 1 | $ 4,100 | $ 4,100 |

| WDCK | Wood Decking w/railings | 112 | $ 3,700 | $ 3,700 |

| BMT | Basement-Unfinished | 1168 | $ 23,800 | $ 23,800 |

| PAT2 | Patio-Good | 316 | $ 2,900 | $ 2,900 |

| SHD2 | Shed w/Elec | 120 | $ 2,600 | $ 2,600 |

| FOP | Open Porch-roof-ceiling | 18 | $ 1,400 | $ 1,400 |

| SPL3 | Pool Gunite | 900 | $ 66,100 | $ 66,100 |

| PATF | Flagstone Pavers on conc | 1344 | $ 34,900 | $ 34,900 |

| SPC1 | Pool Cover-Automatic-Avg | 900 | $ 15,800 | $ 15,800 |

| SPH3 | Pool Heater 800-999sf pool | 1 | $ 4,100 | $ 4,100 |

| TEN | Tennis Court 7200sf-Concr | 1500 | $ 10,300 | $ 10,300 |